W2 Form for Texas Roadhouse If you need your tax form to file between January 1 and April 15 the employee portal is usually the fastest option Current and former employees can often download it online If portal access does not work you can request a copy through your restaurant team payroll or HR This guide shares clear steps fixes for common errors and safe backup options.

Texas Roadhouse W2 Form Overview

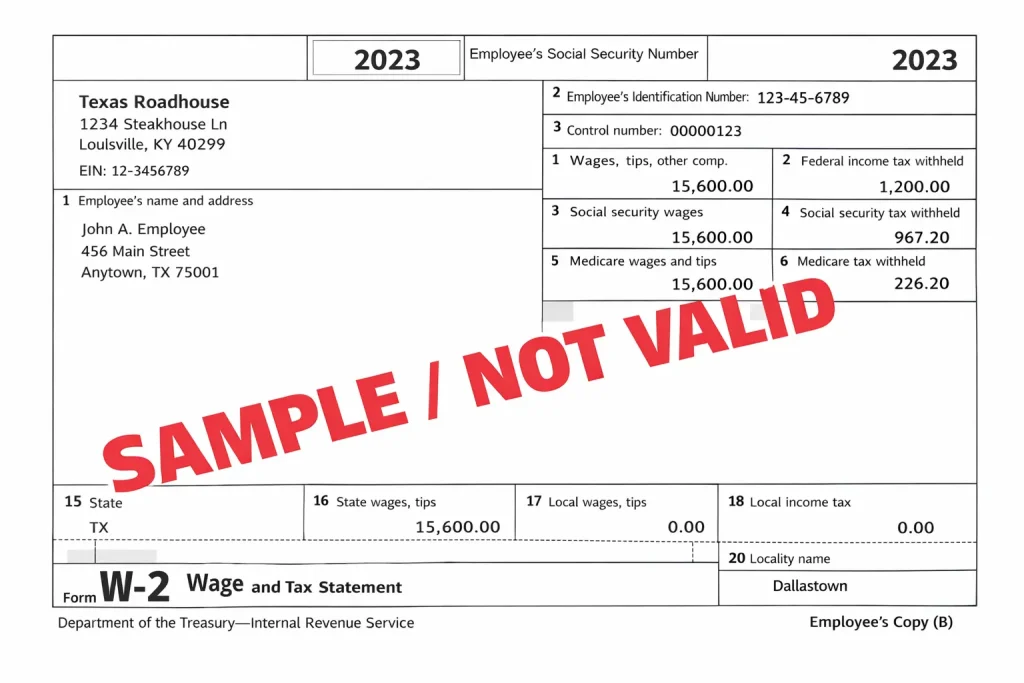

Your Texas Roadhouse W2 Form is a yearly wage summary. It helps you report income correctly and confirm the taxes already taken from your pay.

What You’ll See on the Form

Most copies include:

- Total wages for the year

- Federal and state tax withholdings

- Social Security and Medicare amounts

- Other deductions shown on your payroll record

Why This Document Is Needed

You may need it to:

- File federal and state tax returns

- Check if you may get a refund or owe a balance

- Provide income proof for loans, rentals, or school forms

Download Your Texas Roadhouse W-2 Online

Online access is often the quickest option if your portal account is active.

Step-by-Step Portal Download

- Go to txrhlive.com (employee portal).

- Sign in with your username and password.

- Open Payroll, Pay, or Tax Forms (label may vary).

- Select the correct tax year.

- Download the PDF and print it if needed.

Best Way to Save Your File

Save the PDF in a private folder on your device, then back it up in a secure place. This helps if you need the form again later.

W2 Timing and Key Dates

Knowing the usual schedule helps you avoid last-minute stress.

When It’s Usually Available

Employers generally provide forms by January 31 each year. Online copies often appear in late January, while mailed copies may take a few business days after shipping.

What to Do If It’s Still Missing

If you don’t have it by mid-February:

- Recheck the portal after clearing cache/cookies

- Confirm your mailing address is correct

- Contact your restaurant manager or payroll/HR

TXRHLIVE Login Troubleshooting

Most portal problems can be fixed with a few quick checks.

Fix Password Problems

- Use the password reset option on the sign-in page

- Follow the verification steps

- Try again using a different browser or device

Fix Locked Account and Site Errors

- Ask your manager or payroll/HR to restore access if your account is locked

- Use Chrome, clear cache, and disable VPN if the portal won’t load

- Switch networks if the page keeps timing out

No Portal Access? Request a Copy Another Way

If you can’t get into TXRHLIVE, you still have options.

Get Help From Your Restaurant Team

Your manager or local HR contact can often help you request a reprint. Be ready to confirm your name and approximate work dates.

Request a Paper Copy by Mail

Make sure your mailing address is updated in the system. Ask when it was sent and where it was mailed.

Ask Payroll About Other Systems

Some employers use a separate payroll platform for tax documents. If the form isn’t in the portal, ask payroll/HR if another site is used for access.

External link for wage reporting guidance: https://www.ssa.gov/employer/

Protect Your Tax Form and Personal Details

This document contains sensitive information, so basic safety steps matter.

Simple Security Tips

- Use only official sign-in pages

- Avoid public Wi-Fi when downloading

- Don’t share your login details

- Log out after saving your PDF

Conclusion:

Get your Texas Roadhouse W2 Form through TXRHLIVE first, since it’s usually the fastest option during tax season. If you can’t sign in, reset your password, clear cache, or try another browser. If access still fails, request a reprint or mailed copy from your manager, payroll, or HR. Check early, confirm your address, and keep the file secure. These steps help you receive your form in time to file accurately.

FAQs

Can former employees still get their form?

Yes. Many former employees can access the portal for a period of time. If your login doesn’t work, request a copy through your last location or payroll/HR.

Is a digital copy accepted for filing taxes?

Yes. A downloaded copy from an employer portal or payroll system is generally accepted for tax filing.

What if nobody replies and the deadline is close?

Keep a record of who you contacted and when. If time is tight, a tax professional can guide you on safe filing steps using other pay records while you continue requesting the official form.

How long should I wait before requesting a duplicate?

If you still don’t have it by mid-February, it’s reasonable to request a reprint through your manager or payroll/HR.

What information should I have ready when requesting it?

Have your full name (as used at work), approximate work dates, current mailing address, and a phone number or email for follow-up.